MANCHESTER, NH – The housing market as we approach the end of 2022 differs in important ways from the market a year ago. Interest rates have doubled, and inflation is impacting household budgets. As a result, competition in the purchase market has cooled, increasing pressure in the rental market.

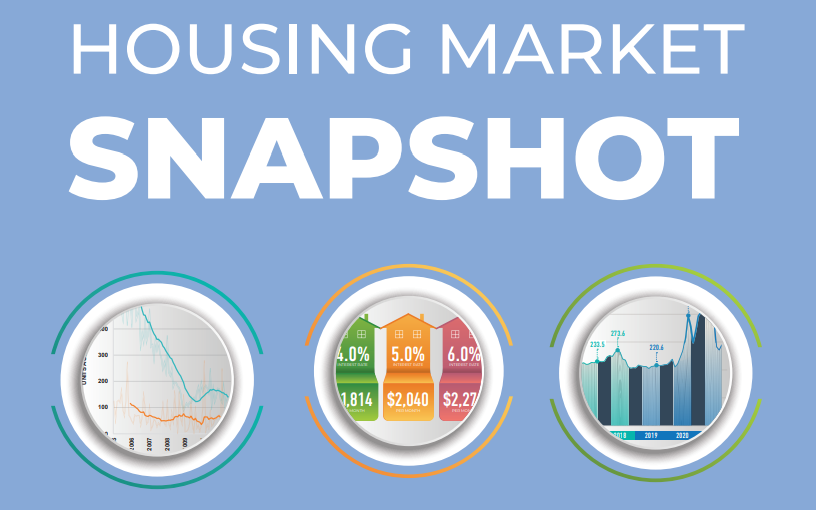

While home prices have stabilized, mortgage payments have become far less affordable; this is vividly depicted in the graphic at the bottom of page 10.

Refinancing activity has dropped significantly as a result of the increase in interest rates. At 6.9%, mortgage rates are at their highest point in two decades. This has resulted in many more adjustable-rate mortgages, which offer a lower rate for a fixed time period. This can present problems for borrowers unprepared for the increased payments that come later. ARMs currently account for about 10% of mortgages, and their appeal is likely to last while rates remain elevated. The decline in demand achieved by rising interest rates has resulted in a modest increase in inventory, but listings remain very low by historical standards. The moderation in prices has done little to blunt the impact of higher rates.

Below: Some data graphics from November 2022 Housing Market Snapshot. [The full report is embedded at the end of this story.]

Despite these challenges, many indicators continue to reflect a strong economy. However, this winter is likely to be a difficult time for many

households, particularly renters. The number of evictions in the state has been low for the past two years due largely to the now-expired federal

moratorium and support provided through the NH Emergency Rental Assistance Program. With rent and utility assistance programs winding down, more low- and moderate-income households could face housing insecurity or homelessness. NH Housing continues to work closely with the state and Community Action Partnership agencies to help these vulnerable households.

For homeowners who are struggling financially to pay their mortgage, property taxes, or utilities, help continues to be available through the

NH Homeowner Assistance Fund program. Information and applications are available at HomeHelpNH.org.

New Hampshire Housing will publish a Housing Needs Assessment study at the end of the year. It will provide a deep analysis of the state’s housing market and needs, quantifying what market dynamics have already made clear: New Hampshire has an insufficient supply of housing to meet the needs of the state’s workforce and residents. Using federal funds, the InvestNH initiative is now targeting different ways to build more housing units and to encourage our communities to be more receptive to affordable housing development. We are hopeful that these new opportunities will soon begin to yield the housing that residents of the Granite State need.

The full report is below: