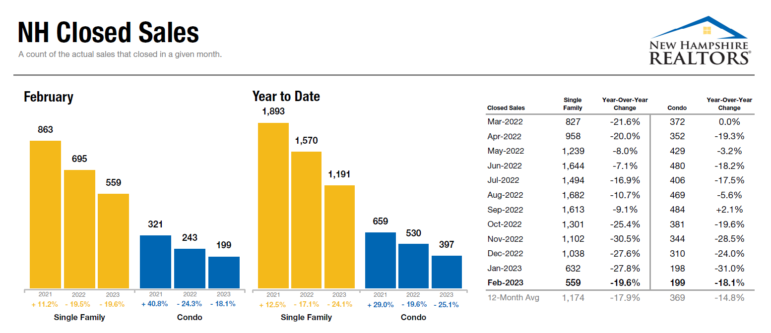

CONCORD, NH – The February housing market in New Hampshire wasn’t budging much from where it had been in January, with affordability and lack of inventory continuing to stall sales, though they were up slightly in February from 12 months before.

“Mortgage interest rates have dipped slightly from their peak last fall, leading pending sales to increase 8.1 percent month-to-month as of last measure, but affordability constraints continue to limit home buyer activity overall, with existing-home sales declining for the 12th consecutive month,” the National Association of Realtors said in its monthly market report.

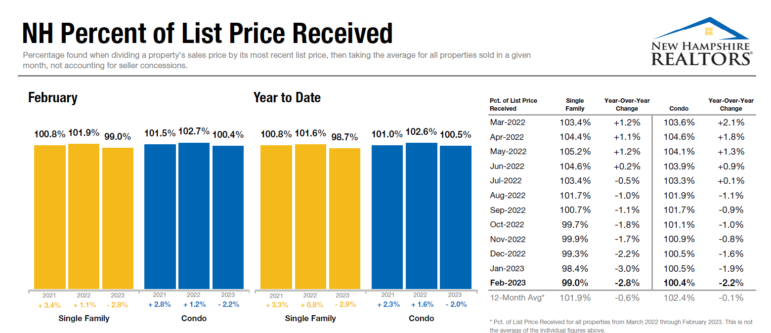

paying the asking price or more for condos (NHAR graphic)

While mortgage interest rates are lower than last fall’s peak, the eighth Federal Reserve interest rate hike in 11 months, to 4.75 percent in February, up from nearly zero in March 2022, is still having an impact, the NHAR said. With buyer demand down from peak levels, home price growth has slowed nationwide.

“Sellers have been increasingly cutting prices and offering sales incentives in an attempt to attract buyers, who have continued to struggle with affordability challenges this winter,” the NHAR said. “The slight decline in mortgage rates earlier this year convinced some buyers to come off the sidelines, but with rates ticking up again in recent weeks, buyers are once again pulling back, causing sales activity to remain down heading into spring.”

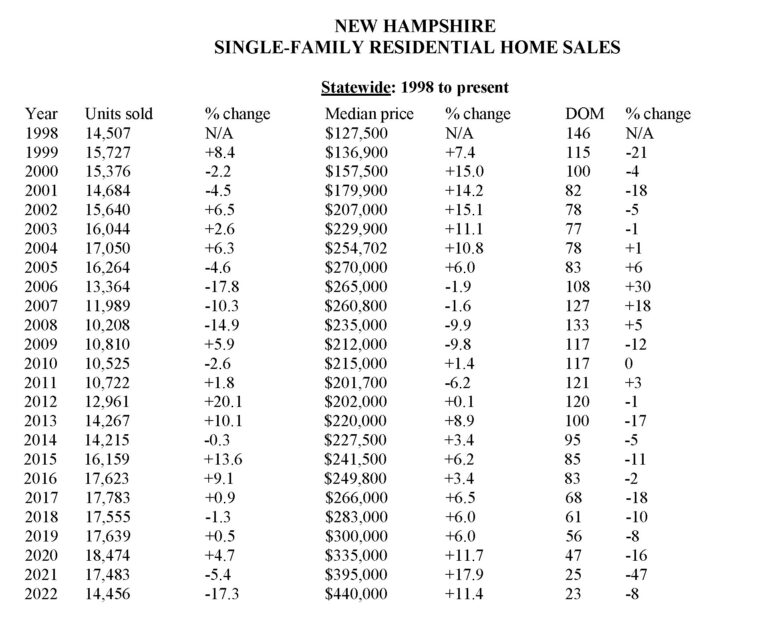

New Hampshire median sales price in February was $425,000 for a single-family home, up 4.9 percent from this time last year, when it was $405,000. In January, the MSP was $410,000. Townhouse-condo median sales price was $342,000 in February, an 18.8 percent rise from 12 months ago, when it was $288,000. It was $339,950 in January. Median means that half of the properties sold at a higher price, and half lower.

Aside from ever-rising prices, inventory is still tight, with one month’s supply available for single-family homes, down from 1.1 in January, and 1.1 months’ supply available for condos, down from 1.2 in January. But it’s well above what it was a year ago, when it was 0.8 for both houses and condos.

The affordability index has dropped to 72, down from 76 in January. A 72 affordability index means that that median income in New Hampshire is 72 percent of what’s necessary to qualify to buy a median-priced home. The index measures home price, as well as interest rates, property taxes and insurance for a median-priced home.

Single family homes spent an average 42 days on the market in February, and when they sold, buyers paid 99 percent of the asking price. At this time last year, homes were on the market for 37 days, with buyers paying 101.9 percent of asking price.

New Listings compared to a year ago for single-family homes were down 20.3 percent, and down 19 percent for condos, with 675 houses and 270 condos listed last month.

Pending sales for single-family homes decreased 4.8 percent and for condos decreased 8.8 percent.