Story Produced by New Hampshire Bulletin

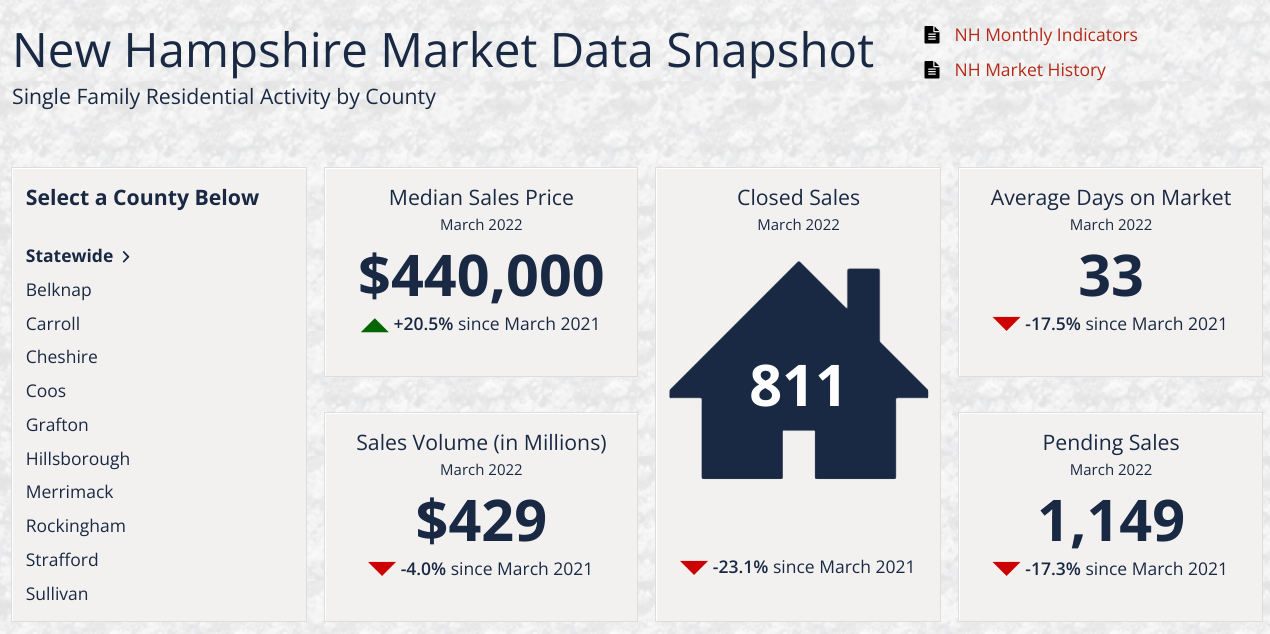

The median price for a new home in New Hampshire continues to skyrocket, hitting a record $440,000 in March, according to the latest monthly snapshot from the New Hampshire Association of Realtors.

The $440,000 median sale price is up 20.5 percent from the same period last year, according to the association. Townhouse-condo properties hit a median sales price of $350,500 last month, a 31 percent increase from last year.

The current median sales price represents a major leap from just February, when the state’s median sales price breached $400,000 for the first time. Sales prices have climbed rapidly in recent years; New Hampshire’s median price first broke the $300,000 mark only in 2019. In 2002, the median home sales price was $200,000.

And one metric often used by real estate agents and industry analysts – the number of months’ supply of inventory – continues to fall. Currently, it would take just “0.8 months” to sell all the state’s inventory if no new homes came on the market, according to the latest report. A healthy market would take six months, housing economists say.

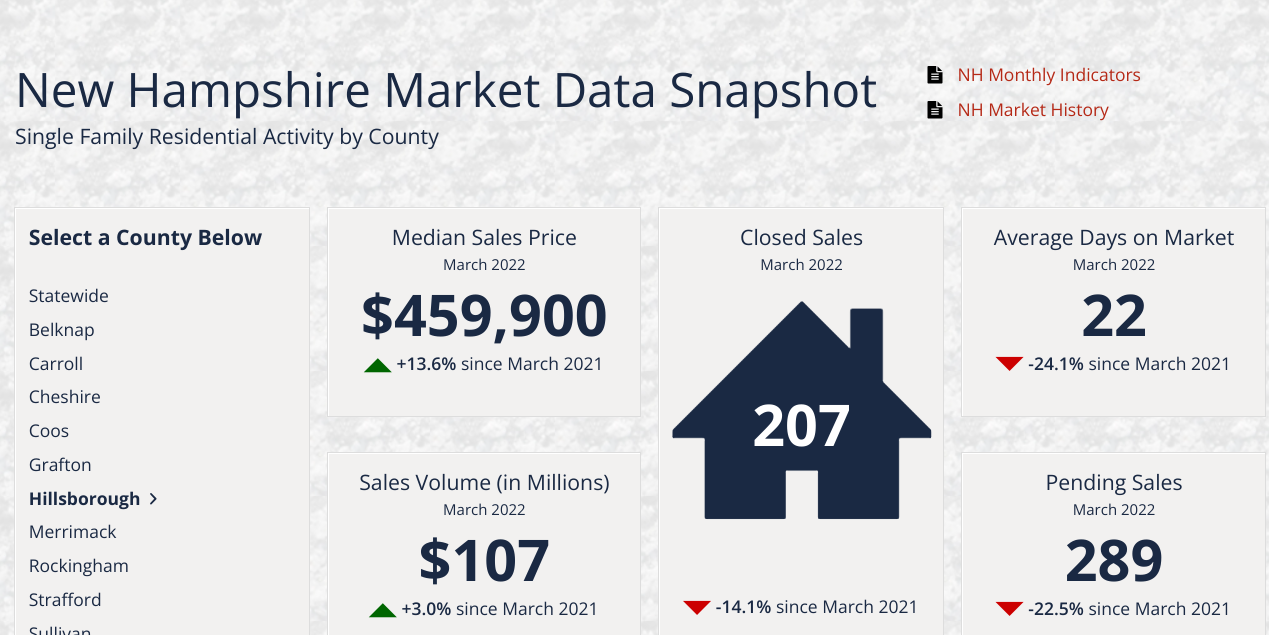

Statewide Snapshot, above, compared to Hillsborough County, below.

Click here to check other regions by county.

As prices have jumped across the state, the number of closed sales has continued to dwindle, dropping 23 percent since this time last year. Just 811 single-family residential home sales were closed in March 2022. Between March 2021 and this March, the number of listings dropped 14.1 percent with just 1,134 on the market.

The high prices and low supply have driven families into the rental market, increased rent, and lowered vacancy rates in the state, analysts say.

Affordability has taken a hit as well. Whereas in March 2020 the median New Hampshire income constituted 126 percent of what was needed to buy the median-priced home, in March 2022 the median income covered only 80 percent of the current sales price median.

“Across the country, consumers are feeling the bite of inflation and surging mortgage interest rates,” the report concluded. “Monthly payments have increased significantly compared to this time last year, and as housing affordability declines, an increasing number of would-be homebuyers are turning to the rental market, only to face similar challenges as rental prices skyrocket and vacancy rates remain at near-record low.”

Story republished with permission under New Hampshire Bulletin’s Creative Commons licensing.