CONCORD, NH – Solutions for the housing crisis won’t come without a foundation of communication and community buy-in, panelists at the New Hampshire Housing 2024 Homeownership Conference agreed Tuesday.

An audience of 350 registered participants – the largest ever for the conference – listened as industry experts discussed the economics, challenges and solutions surrounding home ownership amidst soaring prices and the lowest inventory in decades.

Covering a wide range of topics that included specifics like developer incentives and ADUs, to general themes, like community engagement, the conference focused on the positives that can lead toward solving the state’s housing shortage.

New Hampshire needs 60,000 more housing units by 2030 and 90,000 by 2040, according to the 2023 New Hampshire Housing Needs Assessment. That means that permit and construction activity has to increase by 36%, Rob Dapice, NH Housing executive director told the crowd.

“We need to see more communities stepping up,” Dapice said.

He said it’s not impossible. From 1999 to 2006, building permits in New Hampshire averaged 6,000 a year. “There’s no reason we can’t do it,” he said of the 6,500 needed now.

“It kills me that there are so many people who did nothing wrong who don’t have a place to live,” Dapice said.

The focus of Tuesday’s conference was on solutions, rather than what is wrong with the housing industry, Julie Jussif, managing director of NH Housing’s Homeownership Division, said.

Those attending, organizers hoped, would leave with an understanding of what is needed to advocate for change.

“If we keep doing what we’re doing, we’re not going to fix this housing crisis,” Jussif said.

The overall takeaway from panelists and speakers is that changes must be made to incentivize construction of more affordable units, including on the community level.

Keynote speaker was Chris Herbert, executive director of the Joint Center for Housing Studies of Harvard University.

The panel “Homes for Tomorrow’s Homebuyers,” included Darren Winham, Exeter economic development director; Chris Lee, owner of Backyard ADUs; and Kevin Lacasse, of New England Family Housing. It was moderated by George Reagan, NH Housing community engagement director.

The panel “Building More Homes Through Civic Leadership,” included Peter Nichols, chair of the New London Housing Commission; Molly Lunn Owen, a former Manchester planning board member and past executive director of 603 Forward; and Ian Rogers, a member of Warner’s Housing Advisory Committee. Moderator was Laura Knoy.

Some of the solutions discussed at Tuesday’s conference, by both panels and Herbert, included:

Understand developer incentives

A huge increase in the cost of developing housing means it’s hard for developers to build housing that homebuyers and renters can afford.

Lee described construction costs as untenable. A 740-square-foot accessory dwelling unit his company built for $175,000 in 2019, he couldn’t build in 2024 for less than $275,000.

“That’s not just ADU’s, that’s across the board,” he said.

Lacasse’s company is developing the 944-unit Monitor Way mixed-use project in north Concord that includes market rate and workforce apartments, as well as town homes and condominiums.

He said development costs go beyond just the buildings, and community support, including tax increment financing, is key. Having a developer pay entirely for a $16 million road, for instance, “is a huge barrier.”

In general, TIFs use a percentage of tax revenue to offset the public infrastructure costs of a development. The initial cost is bonded, with tax revenue from the project used to pay off the bond.

When fully built out, Monitor Way, which also includes commercial and community space, is expected to generate $6 million a year in taxes.

Winham, of Exeter, said that the public often sees incentives to developers as handouts to developers. But a TIF, and other developer incentives, are actually ways to use public money to create private investment.

“Yes, it’s tax dollars, but it’s a community helping itself,” Winham said.

He said that 2022’s revision of RSA 162-K, the law governing TIF districts, was a “very, very good change.” It allows municipalities to acquire, construct, reconstruct, improve, alter, extend and more developments that are aimed at improving the town or city’s housing stock.

RSA 79-E, which provides tax incentives to encourage investment and re-use of underused property in town centers, is also a key to more housing investment, Winham said.

Exeter’s Mixed Use Neighborhood Development Districts aim to increase housing, with at least 10% affordable housing in mixed-used properties in commercial districts, with breaks for developers on height, density, parking and setbacks. This year, town residents voted to increase the areas in town where MUND applies, and to allow residential uses on ground floors provided the commercial use is in another ground floor in another building on site.

Winham said this year’s changes to the law are expected to increase housing stock in town.

There is often pushback to developer incentives for housing, Winham said. A community has to have “a heart to heart with itself,” and understand that such incentives mean more investment in their community.

Make it easier to build small homes, rentals

Most of the new homes being built now are large single-family homes, Herbert, of the Harvard housing studies center said. During the housing crisis in the mid-1980s, construction of town homes and condos surged. But that’s not happening four decades later.

“We need new forms of housing, smaller and more cost-effective,” he said. “There’s a market, and builders will build it, but they have to be allowed to build it.”

Manufactured homes – including mobile homes – can’t be excluded from municipalities, according to New Hampshire law, but towns and cities often have restrictions regarding such housing.

Changes in zoning and policy that would allow manufactured housing would help ease the housing crisis, given the “enormous cost advantage,” of such homes, Herbert said.

The estimated cost of building a single-section 1,216 square-foot manufactured home is $56,956, compared to $161,796 for a same-size site-built home, not including land acquisition costs, according to a study Herbert and others did. A double-section of 1,568 square feet would be $109,852, compared to $183,857 for a site-built home. A cross-mod home, a manufactured home with modifications, so it looks more like a ranch-style home, would cost $147,022, compared to $200,582 for a similar-sized site-built home.

“Manufactured housing is [a solution] that’s right in front of us that we have to talk about,” he said.

Those who would like to own homes should have perspective, too.

A couple generations ago, it was normal for siblings to share bedrooms and a household to share bathrooms.

“Nowadays we have this sense that we all have to have our own bathroom,” he said.

Starting out in a condo or smaller home can help build equity and lead to the ability to buy a larger one, he said.

Doing more work on ADUs

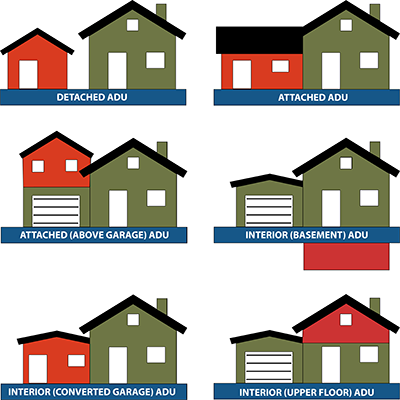

ADUs, which legislation last year permitted in all New Hampshire communities, still face hurdles from local restrictions that communities may impose. The units, a spin on the in-law apartment concept, are an accessory dwelling to a single-family home that provides needed housing, typically to a family member, freeing up other housing.

Lee said policy incentives that would help bring the cost of building ADUs more in line with what would produce affordable housing, including policies that make it easier for ADUs that are aimed at family consolidation, specialized loan structures aimed at ADU construction and incentives to include ADUs in new construction.

He said that the concept of ADU’s as employer housing, with a company investing in developing them for workers, should also be explored.

“Who is getting impacted [by the lack of housing] the most? It’s the employers,” Lee said. They lose 50% of the offers they send out” because recruits can’t find an affordable place to live.

Educating potential homeowners

Studies show that most people – no matter their income, race or age – aspire to own a home. But they also show that there are significant barriers, some financial, some not.

A recent Harris Poll cited by Herbert found 51% of respondents said that lack of capital for a downpayment was the biggest barrier to buying a home.

Herbert said that an increase in downpayment assistance for “income-ready” renters – those who can afford a monthly payment but don’t have the down payment to buy a home – would be an effective tool.

The Harvard Center found that a $25,000 down payment assistance program would have a big impact.

Another barrier can’t be solved with money. The Harris Poll found that 30% cited a lack of knowledge or information about buying a home. This included not knowing the impact of credit score, the amount of downpayment needed and how banks regard debt-to-income ratio.

Communication is key

One big barrier to changing zoning, other policies, increasing housing development, is community pushback. People who are opposed to a development, or new policy, tend to make their voices heard more than those who support it, panelists said.

Nichols, of the New London Housing Commission is a former developer, and has had a lot of experience with community pushback. He’s learned not to take it personally.

Town meeting votes, are simple yeses and nos that leave out a lot of information, he said.

“A ‘no’ doesn’t feel good, but it’s just part of the message,” Nichols said. He said that town officials and board members need to “sit down with the people holding the sign” and find out what’s behind their opposition.

He said that getting buy-in starts with the facts. “Get the information out there, start to engage individuals.”

Lunn Owen said that “a lot of the challenge is educating people without putting the solution first.”

Rogers said that if people don’t know why something is being proposed, or what problem it’s the solution to, they don’t recognize it as a solution.

Lunn Owen and Rogers both said that sharing similar success stories in the community can help people understand what is being proposed.

Lunn Owen also said that people looking to make a positive impact shouldn’t be afraid to get involved. She joined the Manchester Planning Board after learning that there were no renters, or women, on the board.

She said that people discount the effect an email in support of something can have on an elected representative. She also urged people to attend, or watch on streaming, local board meetings to see how the process worked and get engaged in it.

All three of those on the community engagement panel agreed that you don’t have to have lived in a community your entire life, or even a long time, to have a stake in it and make your voice heard.

“Anyone who cares about the community has a say,” Rogers said.

Lunn Owen and Rogers are also examples of today’s housing market challenges.

Lunn Owen and her family had to move out of Manchester after a lengthy search for a house, finally finding one in Concord. She said that it was hard to leave the community that she and her family had developed roots in.

Rogers came back to the U.S. after living overseas for several years, and the changes to the housing market “was an eye-opener.”

He ended up living in his grandparents’ five-bedroom house. When they moved into assisted living, he and his aunt and uncle renovated the house to make it a two-family, and that’s where he lives now.

Rogers said that individuals people looking for solutions “can form good, natural partnerships,” that may help solve individual needs.

Making progress

New Hampshire Housing in 2023 helped more than 900 people buy a home “in every corner of the state,” Jussif said, including about $3 million in downpayment assistance. This year, the agency is on a trend to help even more.

NH Housing’s First Generation Homebuyer’s program, helps bridge the wealth gap, providing downpayment assistance to buyers who’ve never owned a home, and whose parents don’t own a home.

Herbert said that program, and similar ones, that help people afford a home, and close the wealth and racial gap are important. Just as important, he said, is for stakeholders to engage with each other to find such solutions and make them work.

“Too often we’re in our own silos,” he said.